Tracking expenses is crucial for any business. QuickBooks offers tools to make this task easier.

Managing expenses can be challenging, but QuickBooks Expense Tracking simplifies the process. Whether you run a small business or a large enterprise, keeping a close watch on your spending is vital. QuickBooks helps you track expenses efficiently, saving you time and reducing errors.

This blog post will explore the features and benefits of using QuickBooks for expense management. By understanding how QuickBooks works, you can maintain better control over your finances. Let’s dive into how QuickBooks Expense Tracking can help you stay organized and financially healthy.

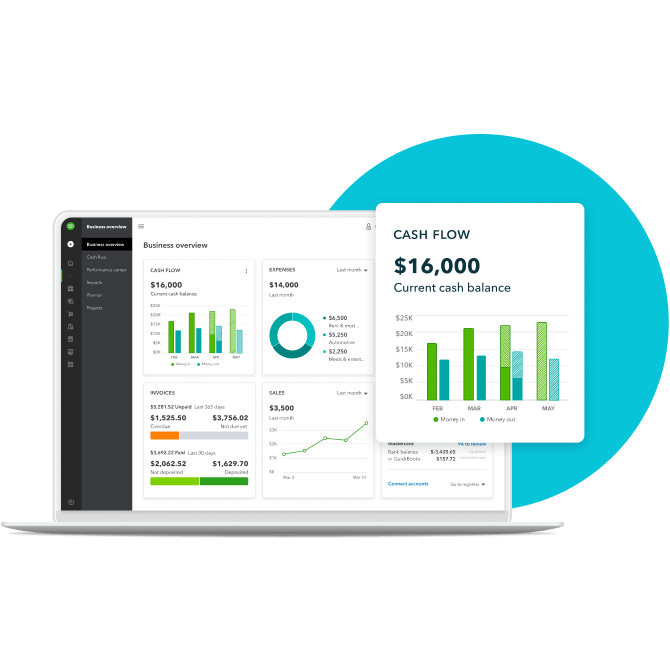

Credit: quickbooks.intuit.com

Introduction To Quickbooks Expense Tracking

Keeping track of your business expenses can be a challenging task. This is where QuickBooks Expense Tracking comes into play. QuickBooks helps streamline the process, making it easier for you to manage and monitor your expenses efficiently. By using QuickBooks, you can save time and focus more on growing your business.

Importance Of Expense Tracking

Expense tracking is crucial for any business. It helps you understand where your money is going. It also helps you identify areas where you can cut costs. Proper expense tracking ensures accurate financial records, which are vital during tax season. It aids in budgeting and forecasting, allowing you to make informed decisions. Without proper tracking, you might overspend or miss out on potential savings.

Overview Of Quickbooks

QuickBooks is a popular accounting software. It is designed to cater to the needs of small and medium-sized businesses. QuickBooks offers a range of features, including expense tracking, invoicing, payroll, and more. Its user-friendly interface makes it easy for anyone to use, even if you are not an accounting expert. QuickBooks also integrates with various other tools and apps, making it a versatile choice for businesses.

With QuickBooks Expense Tracking, you can easily record, categorize, and monitor your business expenses. This feature helps you stay organized and ensures that all your financial data is up-to-date. QuickBooks allows you to attach receipts to your expense records, providing proof of transactions. This can be particularly useful during audits or when reviewing your expenses.

Setting Up Quickbooks

Setting up QuickBooks for expense tracking can be a breeze. It helps you manage your finances efficiently. This guide will walk you through the initial steps.

Creating An Account

To start, you need to create a QuickBooks account. Follow these steps:

- Go to the QuickBooks website.

- Click on the “Sign Up” button.

- Enter your email address and create a password.

- Fill in your business details, like name and address.

- Choose your subscription plan.

- Complete the registration process.

Once done, you have your QuickBooks account ready. Easy, right?

Customizing Preferences

Next, customize your QuickBooks preferences. Tailor it to your business needs. Here’s how:

- Navigate to the “Settings” menu.

- Select “Preferences.”

- Adjust the settings for invoices, expenses, and reports.

- Set up your tax preferences and payment methods.

- Choose your preferred currency and language.

Customizing these settings ensures QuickBooks works best for you. It makes tracking expenses smoother.

Now, your QuickBooks is set up and customized. You are ready to start tracking expenses efficiently. Enjoy the simplicity and accuracy it brings to your business.

Recording Expenses

Recording expenses in QuickBooks is essential for maintaining accurate financial records. It helps you keep track of where your money goes. This process ensures you have a clear view of your spending patterns. QuickBooks offers various ways to record these expenses.

Manual Entry

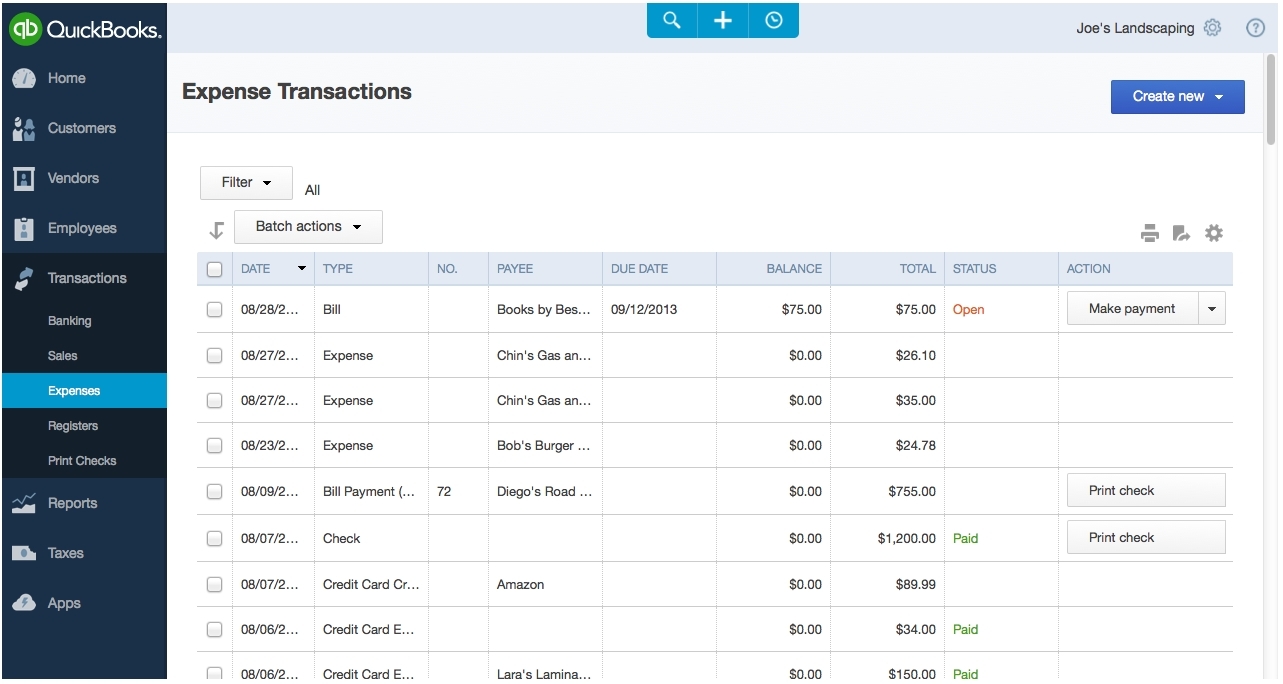

Manual entry is a straightforward method. You can enter each expense as it occurs. This method suits businesses with fewer transactions. To record an expense manually, go to the “Expenses” tab. Click “New Expense” and fill in the required details. Enter the date, amount, and expense category. Don’t forget to save your entry.

Importing Bank Transactions

QuickBooks can connect directly to your bank account. This feature helps you import bank transactions automatically. It saves time and reduces errors. To import transactions, go to the “Banking” tab. Select your bank and follow the prompts. Review the imported transactions and categorize them. This way, your expenses stay updated without manual input.

Categorizing Expenses

Tracking expenses in QuickBooks is crucial for managing your business finances. One key aspect is categorizing expenses. Proper categorization helps you understand where your money goes. It also simplifies tax preparation and improves financial reporting.

Default Categories

QuickBooks provides several default categories to streamline expense tracking. These default categories cover the most common business expenses. Using them saves time and ensures consistent record-keeping.

| Category | Description |

|---|---|

| Office Supplies | Items like paper, pens, and other small office needs. |

| Utilities | Expenses for electricity, water, and internet services. |

| Travel | Costs related to business trips, like flights and hotels. |

| Advertising | Spending on marketing and promotional activities. |

| Meals and Entertainment | Expenses for client meetings or team-building events. |

Using these default categories is straightforward. You can quickly assign expenses to the appropriate category during data entry.

Creating Custom Categories

Sometimes, default categories might not fit all your expense types. That’s where custom categories come in handy. You can create categories tailored to your business needs.

- Navigate to the Chart of Accounts in QuickBooks.

- Click on New to add a new category.

- Select the type of account you need.

- Give your custom category a name and save it.

Creating custom categories helps in several ways:

- Improves the accuracy of financial reports.

- Makes it easier to track specific types of expenses.

- Helps in better budgeting and financial planning.

Custom categories give you more control over your expense tracking. This flexibility ensures that all expenses are accurately categorized.

Tracking Recurring Expenses

Tracking recurring expenses is a crucial part of managing business finances. Quickbooks simplifies this process, helping you stay organized. This helps you avoid any unexpected financial surprises.

Setting Up Recurring Payments

To set up recurring payments, navigate to the ‘Expenses’ section. Select ‘Recurring Transactions’ from the menu. Click ‘New’ to create a new recurring expense. Fill in the necessary details, including the vendor and amount. Set the frequency of the payment. Choose from options like daily, weekly, monthly, or yearly. Save the transaction. Quickbooks will now automate this expense for you.

Managing Subscriptions

Managing subscriptions is simple with Quickbooks. Go to the ‘Expenses’ section again. Click on ‘Recurring Transactions’. You will see all your active subscriptions listed. To edit a subscription, click on the one you want to change. Update the necessary details and save. You can also cancel subscriptions from this menu. This helps keep your expenses under control. Quickbooks makes it easy to track and manage your recurring expenses.

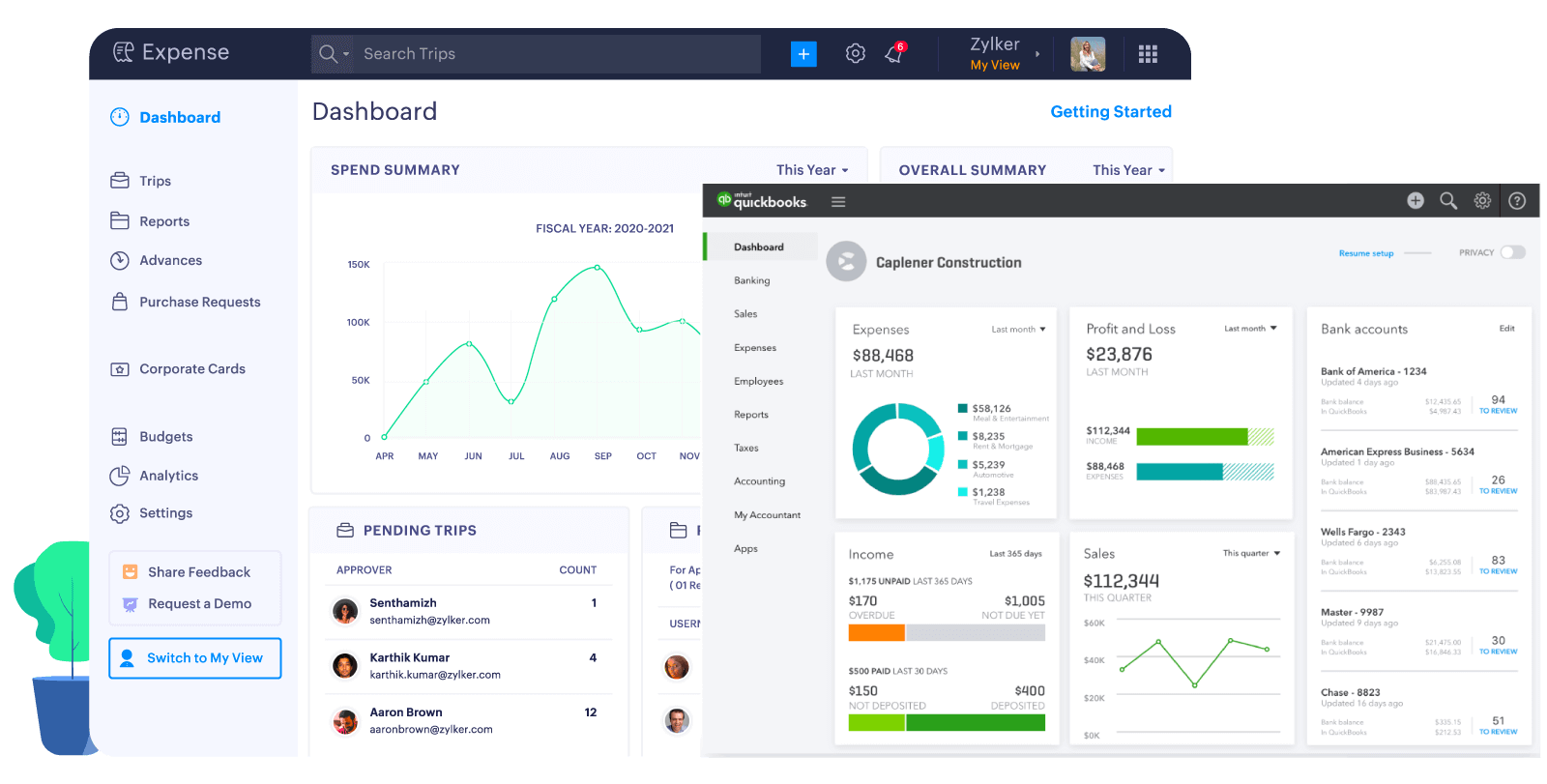

Credit: www.businesswire.com

Generating Reports

Generating reports in QuickBooks can help you keep track of your expenses. These reports give you clear insights into your financial activities. They allow you to see where your money is going. With QuickBooks, you can generate different types of expense reports.

Expense Summary Reports

Expense summary reports provide an overview of your spending. They show you the total amount spent over a specific period. These reports group expenses by categories. This makes it easy to see which categories have the highest costs. You can quickly identify areas where you might need to cut back. Summary reports are useful for budgeting and financial planning.

Detailed Expense Reports

Detailed expense reports give you a deeper look into your expenses. They show every single transaction. You can see dates, amounts, and descriptions for each expense. This level of detail helps you understand your spending habits. Detailed reports are useful for tracking specific expenses. They also help in verifying the accuracy of your records. With detailed reports, you can ensure that every penny is accounted for.

Integrating With Other Tools

QuickBooks Expense Tracking stands out due to its seamless integration capabilities. Integrating with other tools can save time and increase efficiency. You can connect QuickBooks with various essential business tools. This helps in creating a streamlined workflow.

Connecting With Payroll

Connecting QuickBooks with payroll tools ensures accurate expense tracking. It allows easy recording of employee-related expenses. This integration helps in maintaining up-to-date financial records. It also simplifies payroll management.

Expense tracking becomes more efficient with synchronized payroll data. You can track salary payments, benefits, and other employee costs. This saves time and reduces errors.

Syncing With Invoicing Tools

Syncing QuickBooks with invoicing tools offers many benefits. It provides a unified platform for managing expenses and invoices. This integration helps in tracking client payments and outstanding invoices.

It also ensures that all financial data is up-to-date. You can easily monitor cash flow and revenue. This leads to better financial planning and decision-making.

Credit: www.zoho.com

Best Practices For Efficient Tracking

Tracking expenses efficiently in QuickBooks can save time and reduce errors. By following best practices, you can ensure your records are accurate and up-to-date. Let’s explore some key strategies for efficient expense tracking in QuickBooks.

Regular Updates

Keep your QuickBooks data current by entering expenses regularly. Consistent updates prevent backlog and ensure accuracy. Set aside time each week to review and update your records. This habit makes it easier to manage finances and spot discrepancies.

Reviewing Reports

Regularly review expense reports to identify trends and anomalies. QuickBooks offers various reports that help you analyze spending patterns. Use these reports to make informed financial decisions. Look for unusual expenses that may need further investigation.

Troubleshooting Common Issues

QuickBooks is a powerful tool for managing your business expenses. But sometimes, users face common issues that can disrupt the process. These issues can be frustrating but are often easy to fix with the right knowledge. Let’s explore some common problems and how to troubleshoot them.

Duplicate Entries

Duplicate entries can clutter your records and cause confusion. They often occur when you import transactions from multiple sources. To fix this, regularly review your transactions. Look for duplicates and delete any that you find.

To prevent duplicates, connect your bank and credit card accounts directly to QuickBooks. This ensures that transactions are imported only once. Also, set up rules to categorize transactions automatically. This reduces the chance of manual errors.

Incorrect Categorization

Incorrect categorization can lead to inaccurate financial reports. This happens when expenses are assigned to the wrong category. Regularly review your categorized transactions. Check that each expense is in the correct category.

To correct errors, use the “Reclassify Transactions” tool in QuickBooks. This tool allows you to move expenses to the right category quickly. Set up custom categories that match your business needs. This makes future categorization easier and more accurate.

Conclusion And Next Steps

QuickBooks Expense Tracking is a powerful tool for managing your finances. It helps you keep track of expenses efficiently. Below, we discuss the next steps to ensure you get the most out of QuickBooks.

Reviewing Financial Health

Regularly review your financial health. It ensures you stay on top of your expenses. Use QuickBooks to generate reports. These reports offer insights into your spending patterns.

Consider setting aside time each week. Review the following:

- Total expenses

- Category-wise spending

- Unusual transactions

This habit helps you catch any discrepancies early. It also allows you to make informed decisions. Understanding your financial health is crucial for business growth.

Planning For Future Expenses

Planning is essential for financial stability. QuickBooks can assist in forecasting future expenses. Use the budgeting feature to plan ahead.

Here’s how you can start:

- Set clear financial goals.

- Estimate upcoming expenses.

- Allocate funds to different categories.

Having a plan helps you avoid overspending. It also ensures you have enough funds for essential expenses.

Use QuickBooks to track your budget. Compare actual expenses against your budget. Adjust your spending as needed to stay on track.

| Task | Action |

|---|---|

| Review Expenses | Weekly |

| Set Goals | Monthly |

| Plan Budget | Quarterly |

By following these steps, you can make the most of QuickBooks Expense Tracking. It will help you manage your finances better and plan for a secure financial future.

Frequently Asked Questions

What Is Quickbooks Expense Tracking?

QuickBooks expense tracking is a feature that helps you monitor and manage your business expenses. It allows you to categorize and track all your expenditures in one place. This helps in maintaining accurate financial records.

How Do I Track Expenses In Quickbooks?

To track expenses in QuickBooks, go to the Expenses tab. Then, click on “New Transaction” and select “Expense. ” Fill in the details and save. You can also categorize expenses for better tracking.

Can Quickbooks Track Mileage Expenses?

Yes, QuickBooks can track mileage expenses. Use the Mileage Tracker feature to record your business trips. Enter the details of each trip, and QuickBooks will calculate the mileage expense for you.

Is Quickbooks Expense Tracking Suitable For Small Businesses?

Yes, QuickBooks expense tracking is perfect for small businesses. It simplifies expense management and helps maintain accurate financial records. It also offers various features tailored to small business needs.

Conclusion

QuickBooks simplifies expense tracking for any business. Its user-friendly interface saves time. You can easily monitor spending and manage finances. QuickBooks helps you stay organized and make smarter decisions. It’s a reliable tool for growing businesses. Accurate expense tracking keeps your budget on track.

Give QuickBooks a try and see the benefits. Keeping your finances in order has never been easier.